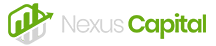

Direct market access

Gain direct access to all the globe’s major stock markets across Europe, North America and Asia. Over 30,000 stocks.

Advanced technology advantage

As a Nexus Capital, you have exclusive access to advanced trading technologies that will give you an edge over your counterparts.

World-class execution

Feel free to trade small, medium or large-cap stocks available in multiple currencies easily. Do all these and experience fast execution.

A vastly experienced broker

Fifteen years of analyzing the top-performing stock markets have afforded us the rare quality of knowing what’s best for our clients.